Investment Management

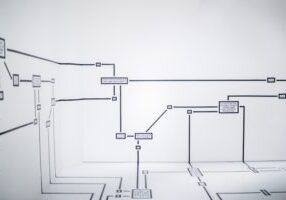

MHP Asset Management offers current portfolio analyses and custom portfolio design

Retirement Planning

Let us assist with your 401k/403b and help turn your retirement savings into planned income

Insurance Consulting

Professional portfolio or insurance consultations custom-tailored to your needs

Meet Mark Patterson

Searching for a financial advisor isn't easy. Meet Mark, an independent financial advisor who works for your best interest (and not to meet a quota or sell investment product). Are your investments working for you?

START HERE!

(We have two suggestions for you.)

We love sharing our knowledge and experience. MHP Asset Management has an entire library of financial tips and topics available for free to all. Below are our most recent financial blog post and our monthly market report.

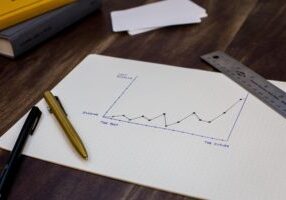

Check out this month's financial market report!

NEXT!

Explore our Financial Topic Library

OR Browse...

Our Latest Financial Blog Posts